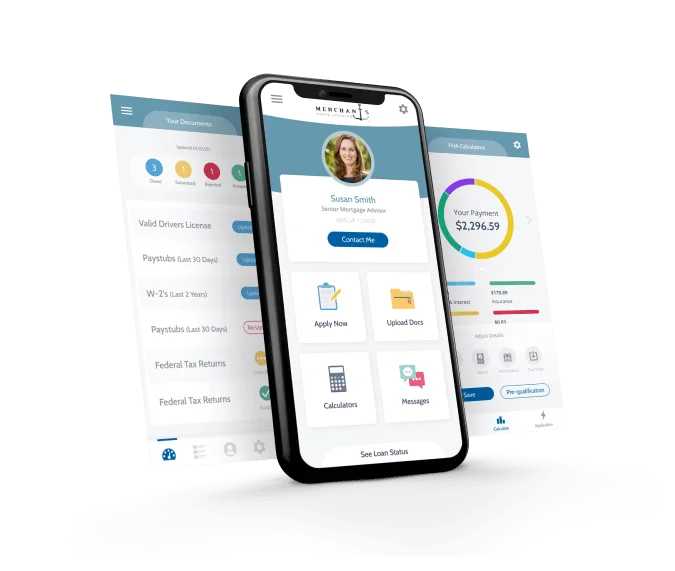

Merchants Home Lending - Specializing in VA Loans

Merchants Home Lending is a leading mortgage company specializing in providing loan solutions, with a strong focus on VA Loans. We understand the unique needs of our customers and are dedicated to helping veterans and their families achieve their dream of home ownership. With a commitment to excellent service and expertise in VA Loans, we take pride in serving the communities of San Diego, Los Angeles, and Sacramento in California.

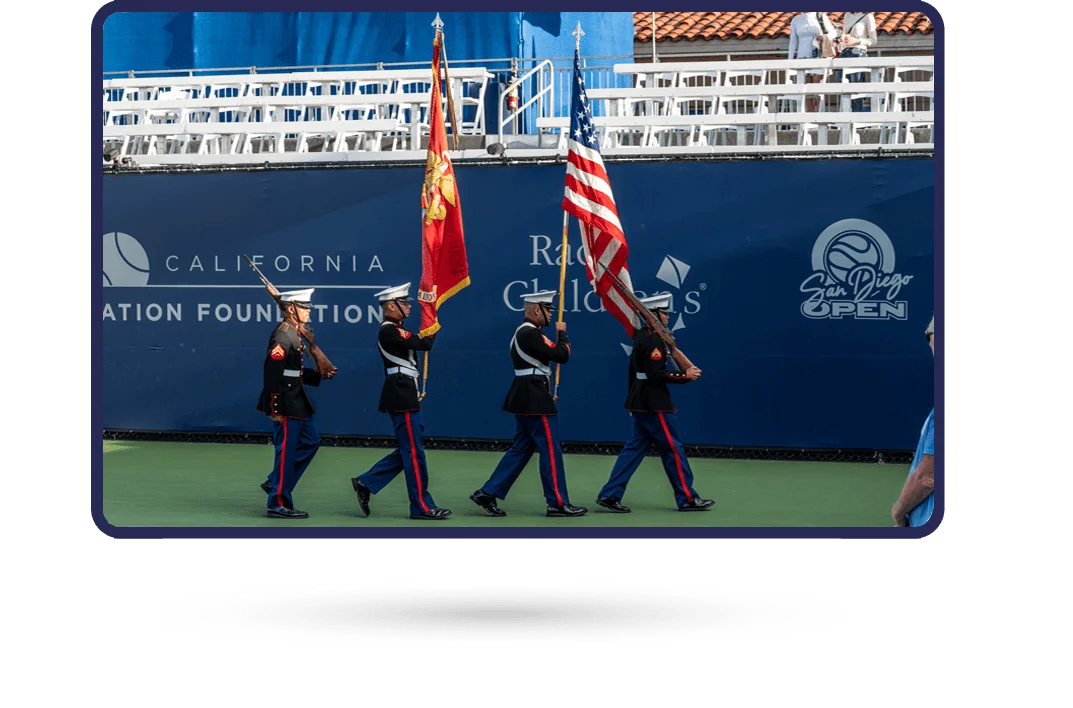

San Diego is a vibrant city known for its beautiful beaches and rich cultural diversity. At Merchants Home Lending, we are proud to be a part of this dynamic community, offering tailored mortgage solutions, including VA Loans, to support the housing needs of veterans and their families. Our experienced team is dedicated to providing personalized assistance to help our clients navigate the mortgage process with ease.

Located in the heart of Southern California, Los Angeles is a bustling metropolis with a diverse real estate market. At Merchants Home Lending, we are dedicated to serving the residents of Los Angeles by providing expert advice and tailored mortgage solutions, including VA Loans, to support the unique needs of veterans and their families. Our team is committed to helping our clients achieve their homeownership goals.

As the capital of California, Sacramento is a city steeped in history and surrounded by natural beauty. At Merchants Home Lending, we take pride in serving the community of Sacramento by offering comprehensive mortgage solutions, including VA Loans, to support the housing needs of veterans and their families. Our knowledgeable team is committed to providing exceptional service and guidance throughout the mortgage process.

Whether its in San Diego, Los Angeles, or Sacramento, Merchants Home Lending is dedicated to providing top-notch mortgage solutions, including VA Loans, to support the unique needs of veterans and their families in these vibrant California cities.